THE MARKET

Cannabis Market is Mainstream & Recession Proof

With 36 US states legalized for medicinal use and 18 states for recreational use, the US is projected to have sales of $20B by 2022.

The Exploding Market

The worldwide market is expected to be $146B by the end of 2025 as the adoption globally continues propelling growth.

GROWTH INDUSTRY NOW MAINSTREAM

- Many have associated the cannabis plant with the psychoactive ‘high’ experienced by the plant’s THC ingredient.

- The plant’s rich CBD (cannabinoid) properties are now being extracted for proven medicinal benefits to help everything from pain, sleep disorders to cancer, and epilepsy therapies.

- The FDA approved the first cannabis-based drug (Epidiolex) in June/2018 and in September/2018 rescheduled CBD to its lowest level of the drug. Many experts expect full federal US legalization to occur in 2019.

- Cannabis is no longer taboo when prominent figures join publicly-traded boards: former US Speaker John Boehner and the former Prime Minister of Canada, Brian Mulroney, both joined public cannabis company boards in 2018.

- On December 4, 2020, the US House passed the Marijuana Opportunities, Reinvestment, and Expungement (MORE) Act to decriminalize cannabis by removing it from the list of federally controlled substances and allowing states to set their own cannabis laws and policies moving forward.

MASSIVE MEDICAL & RECREATIONAL MARKET

- With 38 states legalized for medicinal use and 15 states for recreational (including 4 more in Nov/20), the US industry is projected to be $25B by 2025. Comparatively, the US liquor market will generate $81B in 2019.

- The worldwide market is expected to be $146B by the end of 2025 as the adoption globally continues propelling growth.

- Canada became the first G7 country to nationally legalize cannabis in October 2018 and has taken the lead in capital formation and liquidity.

- 99% of the U.S. population now lives in a state where marijuana has been legalized.

- Cannabis sales in the United States are expected to surpass $15 billion by the end of 2020, approximately 40% higher than 2019 sales, and reach $25B by 2025 (bigger than Craft beer, Pain Meds, or the NBA).

- By 2024, legal adult-use and medical cannabis sales could double that of prescription pain medication sales

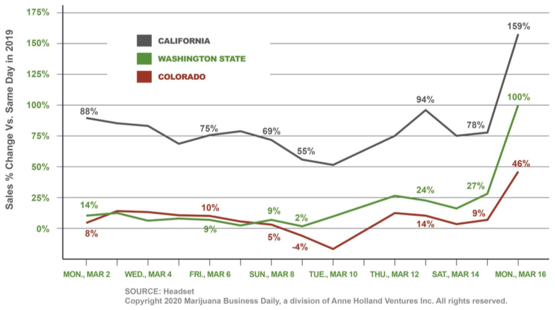

Adult-use cannabis sales in march 2020 by day and market: percent change vs. same day in 2019

Cannabis Market; Recession & Pandemic Proof

Cannabis is one of the few bright spots in the current market.

With 38 US states legalized for medicinal use and 15 states for recreational use, the US is projected to have sales of $20B by 2022 and $25B by 2025.

As the COVID-19 crisis has unfolded, cannabis has evolved as one of the recession-proof-with-increased-demand sectors. In the first 2 weeks of March, same store sales spiked as much as 159% and the average sale was up over 25%. Governments classified cannabis stores as ‘essential services’, allowing them to stay open.

The Opportunity

1,500 Independent Operators With $2B in Sales

Private Value

0.5x – 1.5x of Revenue

Public Value

4x – 12x of Revenue

- Mature Cannabis Markets have stability in regulatory environment & continue to grow.

- Current cannabis public companies have limited experienced cannabis operators or public company experienced execs.

- Vertical Integration has proven the key to the greatest profitability.

-

Mature cannabis market entrepreneurs have been working 5+ years and are ready to monetize.

-

Mature cannabis markets are fragmented with over 65% owned by Independent Operators: 1,500 businesses & $2B of sales.

-

Target Acquisitions can be acquired for an average of 1.0x of Sales and be publicly trading for 4x – 12x of Sales.

The Solution

With 36 US states legalized for medicinal use and 11 states for recreational use, the US is projected to have sales of $20B by 2022.

Unified will be consolidating in three mature markets: Colorado, Oregon, & Alberta, Canada.

Unified’s team, with 100+ years of cannabis operating experience, know how to vertically integrate cannabis operations and maximize profits within a publicly traded company.

Unified‘s public company gives access to liquid stock for currency in acquisitions.

Consolidating into vertically integrated operations provides for 30%+ EBITDA margins.